lottery lump sum vs annuity calculator|Lottery Payout Options: Annuity vs. Lump Sum : Tuguegarao Use the lottery annuity calculator (also a lottery payout calculator) to see how much money you would receive if you opt for lottery annuity payments! In addition, you can . February 11, 2022

PH0 · Things To Do Before Buying an Annuity, According to Experts

PH1 · Powerball jackpot lump sum vs. annuity: Which option is better?

PH2 · Powerball Calculator: Payout, Tax & Annuity Explained

PH3 · Mega Millions Payout Calculator

PH4 · Lottery Payout Options: Annuity vs. Lump Sum

PH5 · Lottery Payout Calculator

PH6 · Lottery Annuity Payout Calculator

PH7 · Lottery Annuity Calculator

PH8 · Best Lottery Tax Calculator: Lottery Winnings After Tax by State

PH9 · Annuity vs. lump sum payout: Which is better?

The Integrated Personnel and Pay System - Army (IPPS-A) is the Army’s online Human Resources (HR) solution to provide integrated HR capabilities across all Army Components. Other Army Sites iPERMS

lottery lump sum vs annuity calculator*******The Powerball jackpot has jumped to $543 million. Here's how to decide between the lump sum or annuity payout option.

Garofoli highlighted the importance for customers to understand the various funding options available, which include making a lump sum deposit or contributing through periodic .

You can calculate your lottery lump sum take home money, annuity payout and total tax amount that you need to pay after winning from Megamillions, Powerball, Lotto, etc by using .

Use the lottery annuity calculator (also a lottery payout calculator) to see how much money you would receive if you opt for lottery annuity payments! In addition, you can .

Lottery Annuity Payout Calculator. When you hit the lottery jackpot you have the option to choose the cash value (also known as lump sum) - grabbing a single big prize, or you .

Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both cash lump sum and annual payment options, so you can compare the two. .Use this tool to compute the net payout after taxes for the Powerball jackpot, whether you choose the lump sum or annuity option. See the payout chart for each option and learn how to adjust . Should you choose an annuity or a lump sum payout if you win the lottery? This article explores the pros and cons of each option to help you make an informed decision.

Lump Sum vs. Annuity Payments: This can significantly impact your tax burden. Let's look at examples for both: Lump Sum: Imagine you win a $10 million jackpot and choose .

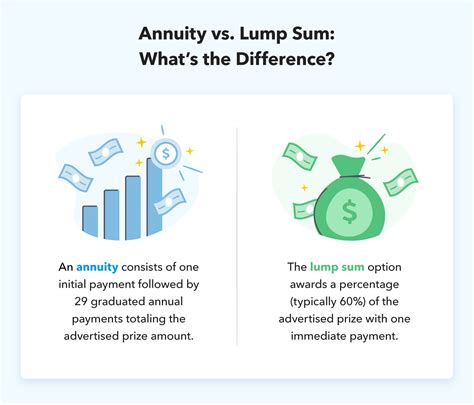

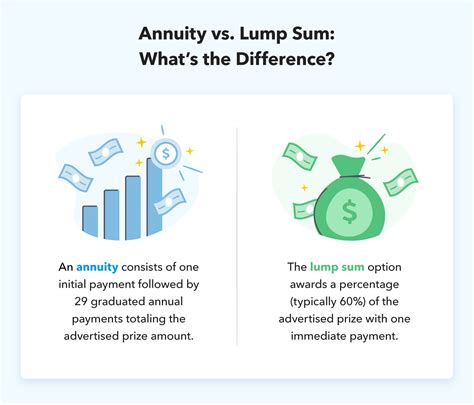

Lump Sum vs. Annuity: The way you choose to receive your winnings can impact your tax burden. Taking the lump sum will likely push you into a higher tax bracket for that year. . This outlines the calculation process for a lottery tax calculator online tool: Inputs: Advertised Lottery Winning Amount (USD) State Name (Selected from a dropdown . If you are lucky enough to win the lottery, you need to make an important decision on how to collect your prize.In general, there are two ways the Powerball pays out: through a lottery annuity or as a lump sum.. In general, if you would like to receive all of your money as early as possible, the lump-sum Powerball payout is the best option for you as you receive all .

An Annuity vs. Lump Sum Calculator is a financial tool designed to compare the long-term value of receiving a large sum of money all at once (lump sum) versus receiving smaller, regular payments over a period (annuity). . It helps make informed decisions when faced with options like pension payouts, lottery winnings, or large settlements .The Annuity Payout Calculator only calculates fixed payment or fixed length, two of the most common options. Both are represented by tabs on the calculator. Lump-Sum. The lump-sum payment option allows annuitants to withdraw the entire account value of an annuity in a single withdrawal. This can be useful in many cases where the entire value of . Lottery Annuity Calculator: This tool is essential for anyone who plays the lottery and wants to understand their options for receiving winnings. When you win a large lottery jackpot, you can often choose between taking a lump sum or receiving your winnings in the form of an annuity.A lottery annuity is like getting a big prize in smaller parts over time. When you win the jackpot, you can choose between receiving a lump sum or an annuity. Taking the lump sum gives you immediate access to cash, while opting for an annuity means you’ll receive a steady, guaranteed income over time. Payment options may vary depending on the state you win in and the specific lottery game you played.The Lottery Annuity Calculator is a tool that helps calculate the amount you will receive annually if you opt for an annuity payout of your lottery winnings rather than taking a lump sum. It factors in the total prize amount, the number of years over which the annuity will be paid, and the annual interest rate.

Our lump sum vs. annuity payment calculator compares two payment options: receiving a lump sum today, investing it yourself, and living off the proceeds after paying income taxes; or receiving an annuity for a specific number of years and paying taxes each year. The calculator discounts the annuity to a present value so that you can compare . Lottery Payouts: Lump Sum vs. Annuity. When you win the lottery, you have the choice of receiving your prize as a lump sum or as an annuity. We explain how they’re different and the pros and cons of each, so you can pick the right option for you. . Example calculation of lump sum lottery taxes: To put this into perspective, let’s say you .

At age 65, you can choose between a single life annuity of $1,470 per month ($17,640 per year) for life or a lump-sum payment of $300,000. At first glance the annuity may appear better, as $17,640 per year is equivalent to that $300,000 consistently generating an annual return of 5.9% ($17,640 ÷ $300,000 = 5.9%).The most noticeable difference between the values of the Powerball lump sum vs the annuity is that the cash option is always lower. The advertised jackpot is always stated as the full annuity amount. The annuity payments are graduated, meaning they increase in value every year, taking into account the profits that would be made if the lottery .

An annuity cashflow calculator for 30 year durations,showing individual payments, plus the federal and state tax implications. Uses the latest tax tables to assist single and joint tax filers. Can be used for lottery, insurance and investment purposes. Compares lump sum cash versus annuity benefits. Mega Millions payout refers to the payment from winning the Mega Millions lottery jackpot. How does Mega Millions payout? Winners of the lottery can choose to collect their Mega Millions payout amount at once as a lump-sum cash payout or in annual payments as an increasing annuity payout over 30 years.. It is good to learn about the Mega Millions payout .lottery lump sum vs annuity calculator Lottery Payout Options: Annuity vs. Lump Sum Lottery Payout Options: Lumpsum Vs. Annuity. Deciding between lump sum or annuity payments for your lottery winnings is a significant decision that requires careful consideration of various factors, including your life expectancy, investment skills, risk tolerance, financial goals, and tax implications.Lottery Payout Options: Annuity vs. Lump SumThe xx lottery offers jackpot winners the choice of either collecting their winnings as a single lump-sum payout, or as a multi-payment annuity. In xx, the annuity consists of xx payments paid one year apart. Each xx payment xxx. The cash payout is approximately 50-80% of the advertised annuity jackpot, but this percentage varies depending on the level of interest rates.lottery lump sum vs annuity calculatorWhether to take a lump sum or annuity from a pension should be more about mitigating risk than maximizing returns.

Using the lottery annuity payout calculator you can see the estimated value of the different payout instalments for each year. The exact amount depends on the rules of the actual game - but most lotteries use a 5% increment and a 30 year period. The sum of the individual payments should equal to the advertised jackpot value.

Welcome to AZNude Live! We're a free online community where you can come and watch our amazing amateur models perform live interactive shows. AZNude Live is 100% free and access is instant. Browse through hundreds of models from Women, Men, Couples, and Transsexuals performing live sex shows 24/7. Besides watching free live cam shows, .Taboo Porn PornGrader. We know how much you love big juicy tits. That’s why we built Huge Tits TV, the number one tube site for huge tits videos. When it comes to massive boobs, there simply is no competition.

lottery lump sum vs annuity calculator|Lottery Payout Options: Annuity vs. Lump Sum